July OPEC output hits 3yr-high as Iran oil returns to market

OPEC pumped 31.5 million barrels per day (bpd) last month as Iran raised its production to 2.86 million bpd, the highest since international sanctions against the country were toughened in June 2012.

The return of Iranian oil to the market could make oil even cheaper than the current lows of about $49.50 a barrel.

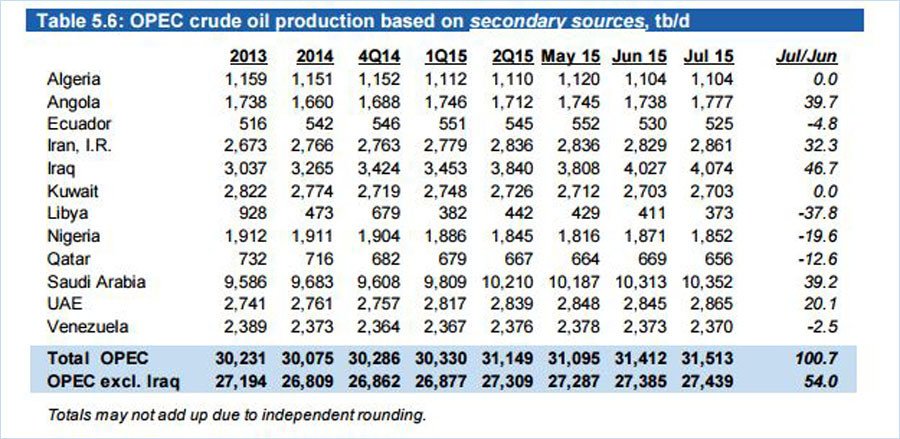

“According to secondary sources, total OPEC crude oil production averaged 31.51 million barrels per day in July, an increase of 101,000 barrels per day over the previous month. Crude oil output increased mostly from Iraq, Angola, Saudi Arabia and Iran, while production in Libya showed the largest drop,” OPEC said in its monthly report Tuesday.

Under the influence of top producer Saudi Arabia, the cartel, which produces more than 40 percent of the world’s oil, has refused to cut output. The Gulf kingdom has told OPEC it reduced its own production by 200,000 bpd to 10.36 million bpd in July.

The World Bank said Monday that when Iran completes its full return to the world oil market, the volume of oil sold will increase by about 1 million bpd. As a result, oil prices will decline next year by about $10 per barrel, or approximately 21 percent from current levels, the World Bank said.

In June, OPEC officially maintained its production quota at 30 million bpd, but has been exceeding it in practice since then. The cartel is seeking to tackle competition from other global players, especially US shale oil producers.

The cartel raised its outlook for oil supplies from non-OPEC countries by about 90,000 bpd in 2015. This is a clear sign that despite Riyadh-led efforts to dump oil prices and thus remove shale oil, which is expensive to extract and refine, from the market, it is taking longer than previously expected to elbow out shale and other players.

READ MORE: Saudi Arabia to raise $27bn in bonds, trying not to sink with oil - media

The massive decline in oil prices, down from $115 per barrel in June 2014, has have hurt Saudi Arabia, too. The oil-rich kingdom, which needs a crude price of $106 per barrel to break even, has spent $65 billion of its reserves since the oil decline began, and intends to raise some $27 billion on bond markets by the end of the year to compensate for lavish government spending.