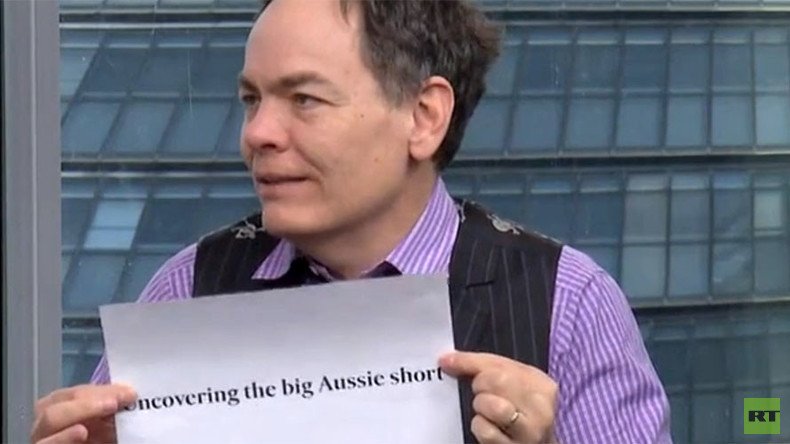

‘This is collusion’: Keiser claims Aussie ‘short’ shows no lessons were learned from 2008 crash

Economist and RT host Max Keiser claims the continued growth of the Australian property bubble proves no lessons have been learned from the crash of 2008 with the same policies that brought financial ruin being repeated.

Keiser’s latest warning came after two prominent hedge fund managers from Down Under, John Hempton of Bronte Capital and Jonathan Tepper of Variant, went undercover posing as a couple house-hunting in the backwater Sydney suburb of Paramatta.

They made a staggering discovery about property prices.

Apartments were selling at US$11,000 per sq meter - exactly the same as in Hong Kong. In Manhattan, rates rise to $14,000 per sq meter, suggesting the Sydney properties are way overpriced in comparison.

“The premise of this was uncovering this big Aussie ‘short’,” said Keiser. “In 2008 during the financial crisis people discovered that prices during the sub-prime wave of that era were way over-priced.

“They made negative bets or went ‘short’ on these properties and made billions of dollars but the response to this was not to discover or examine, ‘Can we stop these big bubbles from happening?’ There has been no reform whatsoever and now we have this huge one in Australia. Isn’t it just a rolling bubble?”

Tepper claimed property bubble ‘Ponzi’ schemes - where people have their homes re-evaluated by banks shortly after purchasing in a bid to increase equity - remain far too common.

“This is collusion,” said Keiser of the practise, which he sees having only one outcome. “We saw this appraisal scam during the run-up to the sub-prime. You had the rating agencies all give bad portfolios of junk bonds higher ratings. Money managers all participated in this. We saw the banks, who were underwriting, participating in this and we saw investors participating and then it all crumbled.”

Big Aussie short critics are 'brain dead'

— Alan Bruce Harvey (@ABH0147) February 27, 2016

https://t.co/AXyQ2Em9CY

Professor Steve Keen, author of Debunking Economics, and a guest on the Keiser Report believes there is no will among the financial powers to make a change.

“The last thing they want to do is have this stuff stop,” he said. “Rather than say this is a ludicrous way to make money, a stupid way to run a capitalist economy, they are saying: ‘How can we keep this going for longer’?”

Keiser is also fearful about how these property bubbles will hurt the wider economy: “The bigger picture is that the global financial markets are completely tied to these asset bubble creations. Hedge-funds are making billions of dollars but there is no credit available for industry - for real jobs and real wages.”