Pennsylvania approves $1.3bn bailout

Pennsylvania lawmakers have approved a financial bailout after a yearlong stalemate over the state’s beleaguered budget. The $1.3 billion revenue package marks the highest election-year tax increase in the state’s recent history.

The grueling debate over the Pennsylvania’s deficit-ridden budget has finally come to a close – for now. The $1.3 billion bailout package is a hodgepodge of tax increases, loans from the state’s medical malpractice insurance fund and new taxes on smokeless tobacco and electronic cigarettes. This makes Pennsylvania the last state to impose taxes on vaping and electronic cigarette products, the News & Observer reported.

#Fracking referendum? Pennsylvania primary offers choice for Democratic voters https://t.co/426zGhs8fppic.twitter.com/RUPrWs4Lrw

— RT America (@RT_America) April 25, 2016

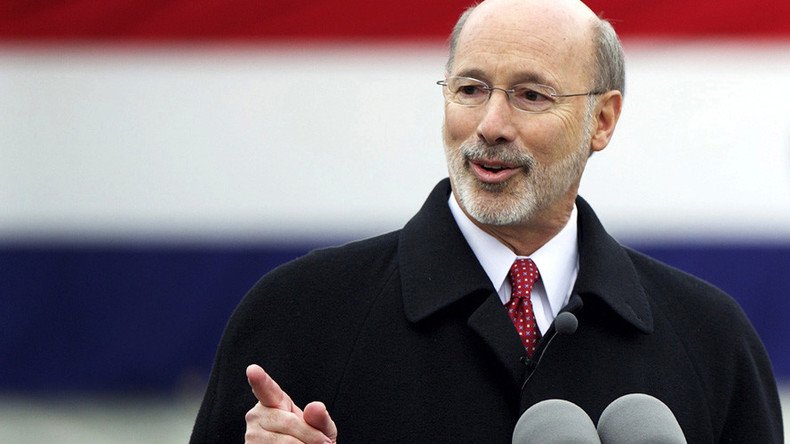

The bailout package was necessary after a $31.5 billion spending plan was approved by the Republican-controlled legislature in June. However, it was the second revenue plan to be pitched by Pennsylvania Governor Tom Wolf (D), who initially pushed for a $2.7 billion tax package. The state’s House and Senate Republicans have historically been averse to tax increases.

Wolf’s previous spending plans for the 2015-2016 fiscal year created a budgetary stalemate between his administration and the Pennsylvania General Assembly.

While Wolf initially sought to use the $2.7 billion package to loosen charter school enrollment caps, to begin closing the disparities between the poor and wealthy school districts, this part of the deal was dropped in favor of increased taxes.

The plan uses a fusion of one-time fixes to help the budget, such as borrowing $200 million from the state medical malpractice insurance fund, along with a tax-amnesty program, extending the sales tax to digital downloads, as well as tax increases on both cigarette packs and wholesale taxes on smokeless tobacco products and electronic cigarettes.

Governor Tom Wolf just signed the revenue package, completing the 2016-17 #PAbudget. pic.twitter.com/7l1bbKcWqn

— Governor Tom Wolf (@GovernorTomWolf) July 13, 2016

The legislature had previously approved supermarkets and other private retailers for wine sales to generate more money from the state’s liquor laws. The House is also backing the legalization of online gaming in order to collect money from licensing fees.

The House approved the bill in a 116-75 vote, and the Senate did so with a 28-22 vote, while conservative lawmakers resisted approving tax increases.

The budget may symbolize true bipartisanship, because, as they say, a good compromise is when both sides feel like they lost.

“It's become very clear to me that while this revenue package is not the best, it is the best Harrisburg can do, at least today,” Rep. Madeleine Dean (D-Montgomery) told the News & Observer, adding: “And the alternative, not to do our job, is unacceptable to me.”

Crowdfunding flop: Alabama senator starts GoFundMe page for state budget, raises only $1,300 http://t.co/9ukUB4hM4cpic.twitter.com/33jIEC5mLh

— RT America (@RT_America) August 14, 2015