'We're all on the Titanic', as old bear says get ready for ugly stock market crash

Swiss investor Marc Faber is known for his pessimistic view of stock markets, and says the S&P 500 index could soon lose more than half of its value.

A rally since late June has the S&P 500 up nearly seven percent in 2016, setting new record-highs almost every day. Faber predicts the index could first grow to 2,300 points from the current 2,182 before the nosedive.

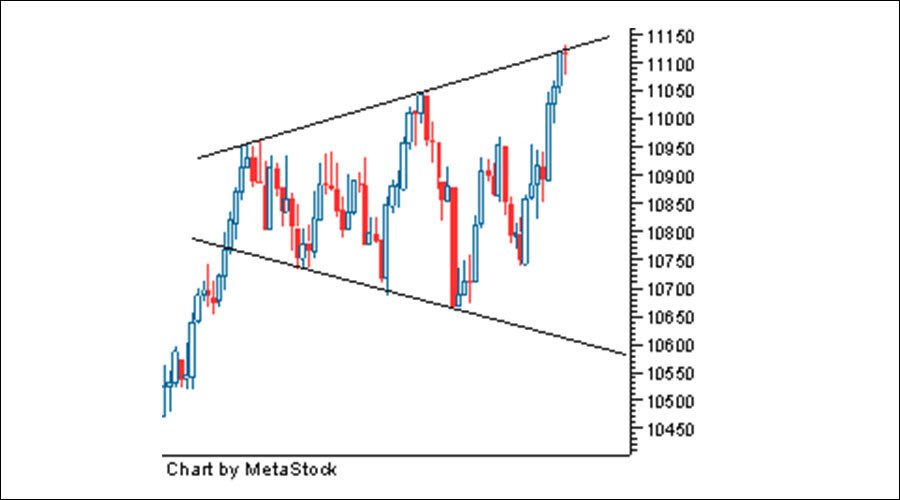

“Maybe we go first to 2,300, then we would have a perfect topping formation. A widening-top formation is about the most bearish technical formation you can have,” Faber said in an interview with MarketWatch.

The investor is referring to the so-called megaphone pattern that resembles a reverse version of a symmetrical triangle, which is a bearish signal indicating the current uptrend may be followed by a steeper downtrend.

“When it unravels, we are going to go to 1,100 on the S&P 500,” Faber said.

Faber, 70, is known for his criticism of central bank policies and the US economy. According to him, printing money may result in markets coughing up the “five years of capital gains”.

“We’re all on the Titanic. When things unravel a colossal asset inflation will burst,” he said.

Faber is often criticized by other analysts, as he has been unsuccessfully predicting the stock market collapse each year since 2012.

BREAKING: Marc Faber A 1987 Style Crash Will Happen In ..... https://t.co/kb1Lkj6gZNpic.twitter.com/U9vOWytBQP

— ValueWalk (@valuewalk) August 9, 2016

To this, Faber replied: “There are lots of people who always criticize me. First of all, they have no money. And I always tell them to send me their audited performance over the last 10 to 20 years and we’ll compare.”

“Everyone has good calls and negative calls,” he said.

Faber is known for advising his clients to rush from the stock market before the October 1987 collapse, dubbed as the Wall Street's Black Monday.

In the 2000s, he also correctly predicted the rise in oil prices, precious metals and other commodities, as well as emerging markets growth, led by China.

His most obvious failures are predicting a "100 percent chance" of a global economic recession in 2012 or 2013 that were followed by global growth. Last year, he predicted gold prices to skyrocket 30 percent in 2015. While they stumbled 14 percent last year, gold has gained 30 percent this year.