OPEC chief says cartel lost $1tn to oil price bust

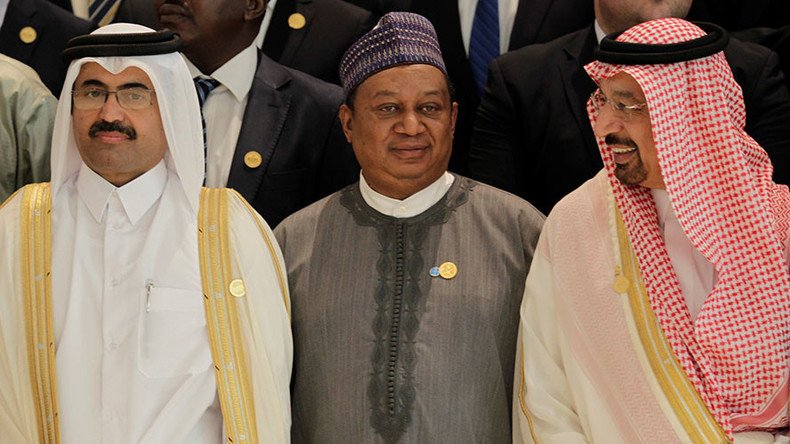

Due to the slump in oil prices, OPEC producers have lost more than US$1 trillion in revenues over the past three years, OPEC Secretary General Mohammad Barkindo has told reporters in Washington DC.

Investments in the oil industry shrank more than 26 percent last year and are projected to drop by another 22 percent this year, Barkindo said on the sidelines of meetings of the International Monetary Fund (IMF) and the World Bank in the U.S. capital.

The estimates for 2017 are also “looking very bleak,” Nigeria’s The Nation quoted Barkindo as saying. For the first time in recent memory, OPEC is not only facing three years in a row of low crude prices, but also declining capex, especially in the upstream business, according to the OPEC official.

Most experts, analysts and agencies, including the IMF and the World Bank, failed to predict correctly how long it would take the market to rebalance, Barkindo noted.

OPEC’s decision to curb production “will go a long way in stimulating stock drawdown”, Barkindo said in late September after the organization had reached a deal-to-make-a-deal on output. Barkindo admitted that the overhang was still huge, and the market had not been rebalancing as fast as the cartel’s producers had wanted.

More on Oilprice.com: Oil Spikes After OPEC Reaches Deal On Output Cap

OPEC may have agreed in principal that it would seek to limit production to a range of between 32.5 million barrels per day and 33 million bpd, but the market is still guessing which member is cutting (if at all) how much, and speculation and rhetoric are rampant.

This week it will be Istanbul’s turn to be the stage for OPEC-related news, comments, hints, and speculation, as OPEC and non-OPEC members hold informal meetings there. A series of other meetings are slated to take place between now and the official meeting in Vienna on November 30, when recommendations on production limits per OPEC member are expected to be reviewed.

Today however, both Iran’s and Iraq’s oil ministers confirmed that their countries will not participate in this week’s Istanbul meeting and Iraq’ oil minister has even called upon oil and gas companies operating in Iraq to increase their production for the rest of 2016 and 2017. This comes after Iraq questioned OPEC’s methods of calculating production estimates for each member state only one day after OPEC announced its new output cap.

The absence of two of OPEC’s biggest producers suggests that the final decision on the freeze might turn out to be even more challenging than already believed. If OPEC doesn’t manage to increase oil prices through the proposed deal, OPEC’s revenue losses may continue to mount.

This article was originally published on Oilprice.com