New law expands IRS surveillance on Americans overseas

A conservative American attorney who has previously taken cases to the United State Supreme Court and won says he plans on pursuing a fight against a new federal tax law expected to go into effect later this year.

The Washington Times reported on Monday this week that lawyer Jim Bopp is putting in motion a plan to challenge the Foreign Account Tax Compliance Act, or FATCA, which once enacted on July 1 will require foreign banks and other financial institutions to report to the US government information about accounts registered to Americans worth more than $50,000.

Earlier this month, the IRS said it will implement the law throughout a grace period starting in July and stretching through 2015. Once fully enforced, however, the US may rely on FATCA to fine foreign governments who fail to comply, and take as much as 30 percent of whatever is held in those personal accounts.

According to reporter Ralph Z. Hallow at The Washington Times, “Foreign banks are refusing to comply because of the costs resulting from extra paperwork and labor.” Bopp doesn’t seem to blame them, and now says he is prepared to argue against the law all the way to the Supreme Court.

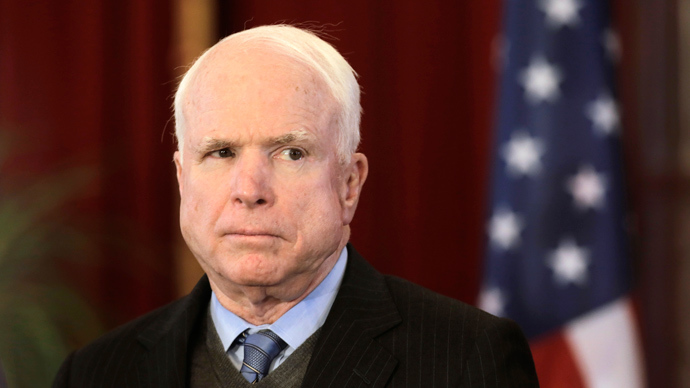

Previously, Bopp succeeded in getting the high court to strike down elements of the Bipartisan Campaign Reform Act of 2002 spearheaded by Senators Russ Feingold (D-Wisconsin) and John McCain (R-Arizona). Sen. McCain is again among the group of lawmakers who advocates in favor of FATCA, Hallow reported, and Bopp once more hopes to have at least elements of the law struck down by SCOTUS.

“McCain seems to think that all Americans abroad are tax cheats, when in fact they aren’t, and their work overseas is vital to our economy by promoting the sale of our products around the world," Mr. Bopp told the Times.

On his part, McCain and congressional colleague Sen. Carl Levin (D-Michigan) signed a letter to Secretary of the Treasury Jack law last month asking that FATCA quickly be enforced after July 1 to further sanction Russia, then perhaps other countries abroad.

“FATCA sanctions provide a powerful, nonmilitary option that, when added to the other financial sanctions already imposed, could help deter Russia from continuing its threatening actions against Ukraine,” the senators wrote in their April 29 letter to Lew.

But opponents of the bill, including Bopp, say the new tax law is illegal on multiple grounds. The attorney is attributed with co-founding the group Republicans Overseas — a political organization for Americans living and working abroad, according to its website — and since its incarnation last September has fought to protect the rights of GOP members outside of the US.

Solomon Yue, the Republicans Overseas chief operating officer and an Oregon Republican National Committee member, told the Times that “Seeking legal rather than legislative remedy on behalf of Americans living abroad before the scheduled July 1 full implementation of the law is the only available course for now.”

“The legal help is on the way since we have three potential constitutional claims against the FATCA beast that was created in the US, forced upon other nations and must be brought down in the US justice system,” he added.

Indeed, the Times article outlined the three arguments that Republicans Overseas hopes to argue all the way to the Supreme Court. According to the group, the act not only violates the treaty powers provided to members of the Senate through the US Constitution, but also infringes on protections against both unusual punishment and the unreasonable search and seizure of Americans’ financial assets abroad.

“FATCA violates citizens' right to privacy,” Yue told the Swiss financial newspaper L'agefi recently. “Personal financial data transferred from foreign banks to the IRS violates the Fourth Amendment which prohibits unreasonable searches and seizures without a warrant. However, even living abroad, a US citizen still is protected by our Constitution.”

“Using an IGA (Intergovernmental Agreement) between the US government and a foreign government as a license for a warrantless search is unconstitutional,” Yue added. “In addition, the Eighth Amendment prohibits cruel and unusual punishment. This means that the punishment must be proportionate to the crime. Just imagine a retired American citizen who receives his monthly pension check abroad and the IRS withholds 30 percent of the check because his foreign bank, through which the fund transfer is made, is not FATCA compliant? This could happen to a public school teacher, who taught English and retired abroad. His pension is managed by a US bank in New York.”

When asked by L'agefi if there’s a chance his case will make it to SCOTUS, Yue said that Republicans Overseas “asked the best constitutional litigator in the US, James Bopp Jr., to examine this FATCA case and we are waiting for his preliminary legal opinion on the FATCA law.”

“It will take time and other lawyers must review the legal opinion. But what we can already say is that the issue of FATCA is not closed,” Yue said.

Even if FATCA does success, however, others have raised concerns about whether or not it will even be successful.

"If the first several months are a disaster, it could lead to calls for its repeal," Villanova University law professor J. Richard Harvey, told the Wall Street Journal recently. "By signaling they will ease enforcement, they are hopefully taking some of the pressure off the initial implementation."

The IRS has previously delayed implementing FATCA no fewer than two times, according to Reuters.