Plan B: Central banks getting ready for financial Armageddon

If the US debt-ceiling debate goes past the eleventh hour, and the default of the world’s largest economy becomes a reality, leading central banks around the world are gearing up to minimize losses and keep the world economy functioning.

Follow RT's LIVE UPDATES on the US budget crisis

If US lawmakers don’t reach a budget consensus and raise the debt

ceiling by Thursday October 17, the US will become the first

Western power to default since Nazi Germany in 1933, and will

send markets into uncharted territory.

The rest of the world is bracing itself for what would happen if

the bill is rejected, and the US inches closer to defaulting on

its debts, which are largely foreign- held in the form of US

Treasury Bonds.

Central banks have begun preparing for the worst-case scenario if

US does fault, which would result in a serious devaluation of

Treasury bonds, delayed payments, and a more large-scale version

of the current government shutdown.

“Because in the past it’s always been sorted out is absolutely

not a reason to fail to do the contingency planning,” Jon

Cunliffe, who will become the Bank of England’s deputy governor

for financial stability in November, told UK lawmakers.

“I would expect the Bank of England to be planning for it [US default]. I’d expect private-sector actors to be doing that, and in other countries as well,” said Cunliffe, who acknowledged a default as “the main risk to the [global] financial system”.

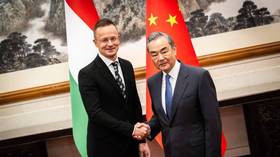

The European Central Bank and the People’s Bank of China (PBC)

have struck a deal that moves both banks farther from the dollar

orbit. The two banks agreed to ‘swap’ $56 billion worth of yuan

for $60.8 billion worth of euros.

Many central banks have reserves in the form of Sovereign Wealth Funds, which are also at risk if the US defaults, as many of the assets are held in dollars. These investment vehicles could be crippled by a default. China’s is estimated at more than $1.3 trillion - the world’s largest.

A historic shift

Neil Mackinnon, a former UK Treasury official, told RT the US

default tango marks a shift in the global economic paradigm, from

West to East.

If the US doesn’t act soon, “the dollar will decline and its

importance will move to a multi-polar currency system and other

currencies will take on board more importance,” said

Mackinnon.

Over the weekend, economic leaders from around the world met in

Washington DC at the International Monetary Fund’s annual

meeting. The fund’s managing director, Christine LaGarde, issued

a harsh warning the global financial system could enter a

recession if the US misses its debt deadline.

The US Senate said they will announce a deal to end the shutdown

and extend the debt ceiling on Tuesday, which will pass through

to the House, where it will face Obama’s hard-nosed Republican

opponents who want to cut funding of the Affordable Care Act.

Senate Majority Leader Harry Reid, a Democrat, said Tuesday has

the potential to be a “bright day” and bring calm back to the

global markets.