Higher oil prices could drag OPEC’s ‘best customers’ into recession, expert warns

If OPEC members decide to boost oil prices by cutting production, this may severely hit some of the cartel’s key customers in China and other Asian countries, Ed Hirs, Managing Director of Hillhouse Resources an oil investment firm told RT.

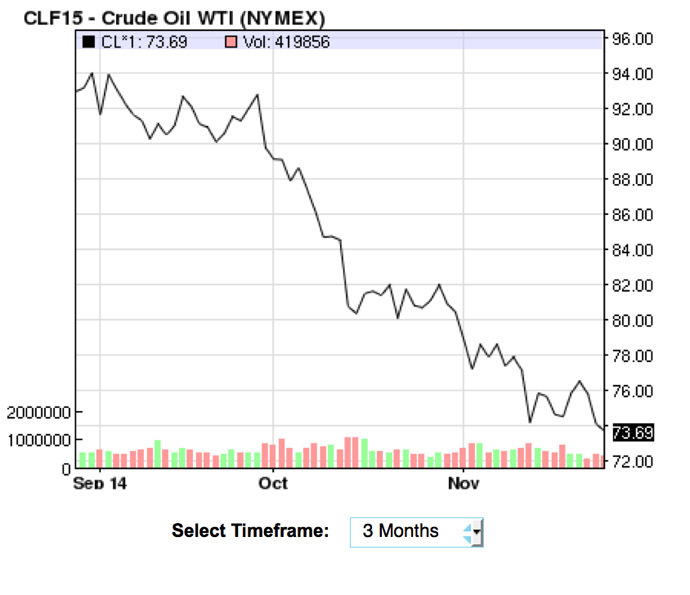

The oil prices hit a new four–year low on Thursday ahead of the meeting of the 12 member states of the Oil Producing and Exporting Countries (OPEC) in Vienna. January futures for Brent crude slid to $76.5/bbl by 12.00 MSC, with WTI futures going down to $72.92/bbl.

READ MORE: Fitch names oil exporters 'vulnerable' to credit downgrades if weak prices persist

While lower oil prices are hitting some of the OPEC member states like Iran and Venezuela, there are certain winners from the cheaper commodity, like China, the world’s second biggest oil consumer, and India. If prices go up, some emerging economies could start contracting, Hirs explained in an interview with RT.

“If they [OPEC – Ed.] raise the price of oil and its sends these economies into a recession, that would lead to a lower demand of oil and could create a worldwide effect of lowering prices even later next year, and lowering demand,” he said.

#OPEC breakfast. This is what you get when the oil price falls below $80. pic.twitter.com/4rhmCBIUJd

— Jonah Hull (@jonahhull) November 27, 2014

The US dollar has been steadily rising over the last year and a half. As oil is the biggest commodity traded worldwide in dollars that means oil has become more expensive for OPEC’s major Asian customers Hirs said. He believes OPEC began to let the price fall in order to keep these economies from falling into recession.

READ MORE: Ruble-yuan settlements will cut energy sales in US dollars – Putin

The prices of oil are being driven down primarily by intense shale oil exploration in the US which has added about four million barrels per day since 2008. Another factor is easing the sanctions against Iran and its gradual return to the world oil market, as well as the growing production from Libya and Iraq.

“A simple increase of just one percent of supply can drive the price of oil down 25%,” the expert explained.

Within OPEC certainly there are a lot of differences, because the organization is divided into two camps. On the one hand there are the rich Gulf States which have built themselves huge capital that they can fall back on when the oil price plunges. The poorer states, such as Latin American and African countries, depend on the price of oil being a certain value.

READ MORE: Saudi Arabia to keep politics out of OPEC, will let market stabilize price

“OPEC has got to decide, if they want to do a production cut and increase the price of oil, and what that will do to the economies of their best customers,” Ed Hirs concluded.