Visualizing wealth inequality: 400 richest Americans vs 36 million cat-owning households

The 400 richest American fat cats have as much wealth as the bottom 36 million US households. To illustrate just how much prosperity the average American is missing out on, a new study uses the Space Needle, private jets, cats, and more.

The report is based on the Forbes Magazine list of the 400 richest Americans, and compares the billionaires’ concentrated “extreme” wealth with the “much more meager assets of several different segments of American society,” authors Chuck Collins and Josh Hoxie wrote in their introduction. The study, titled Billionaire Bonanza Report: The Forbes 400 and the Rest of Us, was published by the Institute for Policy Studies, an independent think tank based in Washington, DC.

“The level of US wealth inequality has grown so lopsided that our classic wealth distributional pyramid now more resembles the shape of Seattle’s iconic Space Needle,” the authors wrote, with the bulge at the top representing America’s wealthiest 0.1 percent, or the estimated 115,000 households with a net worth starting at $20 million. This group owns more than 20 percent of US household wealth, up from 7 percent in the 1970s, or about as much wealth as the bottom 90 percent of Americans combined.

The nation’s wealthiest 400 people, as ranked by Forbes Magazine, are “a cohort small enough to dine in the rotating luxury restaurant atop the Space Needle in Seattle,” according to the authors. Those 400 fortunes are all worth at least $1.7 billion each, or more than the combined wealth of the bottom 61 percent of Americans ‒ about 70 million households, or 194 million people, which is more than the combined populations of Canada and Mexico.

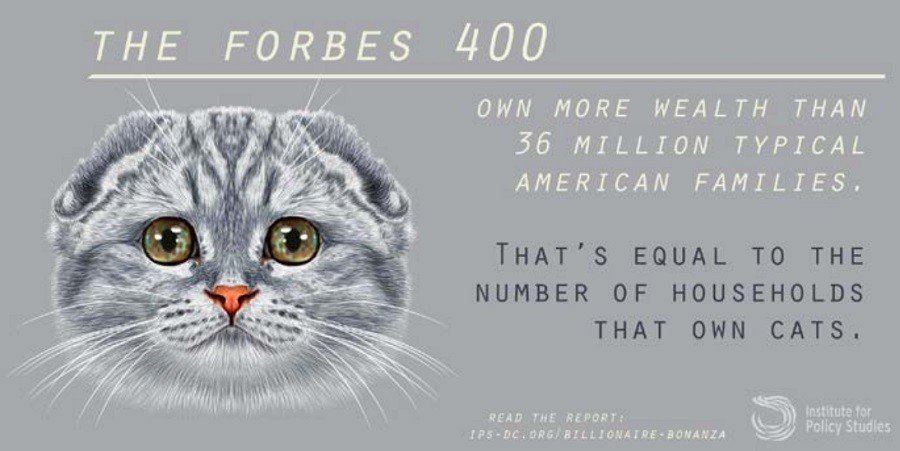

With the average American household holding $81,000 in wealth, the members of the Forbes 400 list have more combined wealth than 36 million typical US households. There are also 36 million homes with cats in the United States.

As Forbes Magazine points out, however, that’s what happens when the study’s authors assume that “cat owners have only the median wealth of an American household.”

“Well, yes, this is going to be true because that’s just the way that wealth distributions work. They are hugely unequal, by definition,” Forbes contributor Tim Worstall wrote.

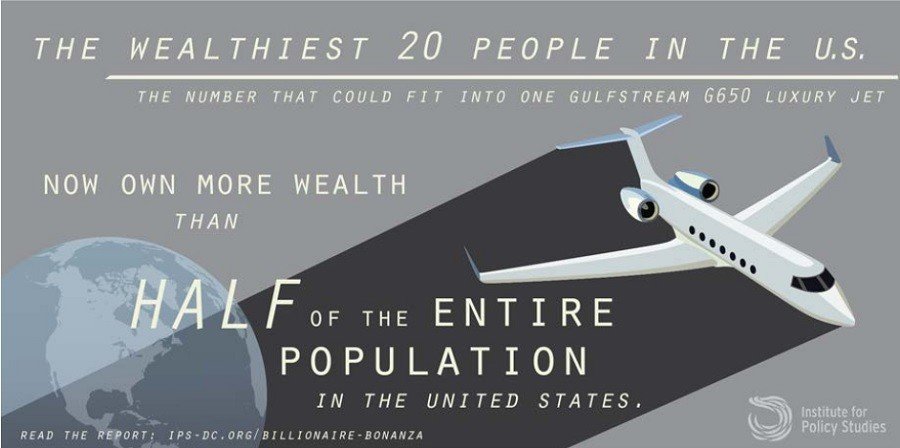

The report found that the 20 wealthiest Americans, who could fit into a luxurious Gulfstream G650 private jet, have as much wealth as the 152 million people making up the bottom half of US households ‒ a combined $732 billion.

“This private jet metaphor could hardly be more appropriate. The 2015 Forbes 400 special issue features eight advertisements for private luxury jets, some running several pages long, as well as a special private jet promotional supplement entitled ‘The Mobility Advantage,’” the authors wrote. “Very few on the Forbes 400, we can safely assume, fly on commercial flights.”

The Gulfstream club includes Microsoft founder Bill Gates ($76 billion), Berkshire Hathaway CEO Warren Buffett ($62 billion), Oracle founder Larry Ellison ($47.5 billion), Amazon founder and CEO Jeff Bezos ($47 billion), Koch Industries’ Charles and David Koch ($41 billion each), Facebook founder Mark Zuckerberg ($40.3 billion), former New York City Mayor Michael Bloomberg ($38.6 billion), Walmart heir Jim Walton ($33.7 billion), and Google founders Larry Page and Sergey Brin ($33.7 billion and $33.3 billion, respectively).

The news is even worse for Americans of color than it is for whites in the US. The average white family today has net assets of $141,900, compared with just $11,000 for black families, the same net worth African-Americans had in 1985. The average Latino family holds $13,700 in wealth.

The Forbes 400’s billionaires have as much wealth as all of America’s African-American households, plus one-third of America’s Latino population, combined. If you look at just the top 100 on the list, they own as much wealth as all of the 42 million blacks in the US (13.2 percent of the US population), while the top 146 own as much as the Latino population of more than 55 million people (17 percent).

Both African-Americans and Latinos were hit far harder economically by the Great Recession because they were disproportionately offered risky subprime mortgages and were more likely to face job and wage cuts during the economic slowdown, according to Mother Jones.

Collins and Hoxie argue that there are two ways to close the wealth gap: prevent affluent individuals from shifting their wealth into offshore tax havens or private trusts, and implement policies to reduce concentrated wealth, including taxing the most prosperous households, using the raised revenue to invest in wealth-building opportunities for the less well-off.

“We believe that these statistics actually underestimate our current national levels of wealth concentration. The growing use of offshore tax havens and legal trusts has made the concealing of assets much more widespread than ever before,” they wrote (emphasis original).

The study authors and Worstall both refer to a 2014 paper on wealth inequality in the US by Emmanuel Saez and Gabriel Zucman. However, Worstall notes, the authors “failed to grasp some of the things that paper says” ‒ most notably that: “The bottom half of the distribution always owns close to zero wealth on net.”