Tax reform deadline may be in jeopardy with Senate & House GOP split on proposals

Senate Republicans have unveiled their version of the tax overhaul bill, but must now find common ground with House Republicans, as the two chambers have profound differences in their proposals that affect individuals, families and businesses.

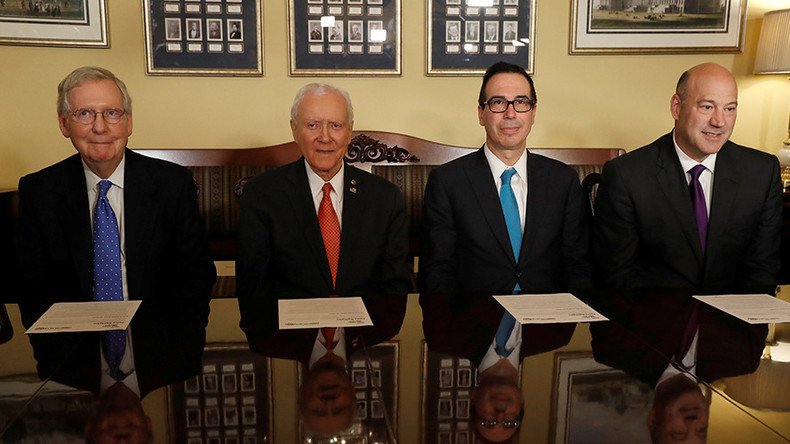

Republicans on the Senate Finance Committee released their tax bill Thursday, drawing sharp contrasts with the House version. President Donald Trump expects to sign the tax reform bill into law this year, but that will depend on whether the GOP can iron out their internal wrinkles in time.

A major difference in the two GOP bills is the issue of state and local tax (SALT) deductions. The Senate’s version eliminates the SALT deduction completely, with taxpayers losing the opportunity to deduct their state and local property, along with other taxes, from their federal filing.

House Republicans set forth only a partial repeal of SALT in their model, allowing for $10,000 in property taxes to be deducted. Senate Republicans are reportedly not willing to compromise on this issue, citing revenue concerns.

If the Senate and the House end up disagreeing on key issues, they will have to form what is called a “conference committee” to negotiate and create a new bill that both the Senate and the House will have to pass in their respective chambers. Or, alternatively, one chamber could legally take the other assembly’s bill and pass that piece of legislation, which would result in that being the final tax bill.

Both the Senate and the House look to drop the top corporate tax rate from 35 to 20 percent, but the Senate's version of the legislation would not lower the rate until 2019, one year after the House bill’s date. The Senate’s delayed cut is supposed to help avoid an exploding deficit, but critics argue that economic growth will be stunted by the deferral.

The Senate bill also differs from the House bill in relation to the current seven US tax brackets.

The Senate’s proposals keeps the current system intact, but lowers the top category from 39 percent to 38.5 percent.

In an effort to simplify the tax code, the House's version looks to cut the seven brackets down to four, which will end up costing $1 trillion over the next decade. This will happen because some tax filers, specifically those earning between roughly $500,000 to $1 million each year, will pay less in taxes, according to the Washington Post.

READ MORE: Sen. Rand Paul’s attacker may face more serious charges, due to life-threatening injuries

Senator Jeff Flake (R-Arizona) tweeted his reaction to the Senate bill Thursday, saying, “We need real, fiscally responsible #TaxReform that doesn't explode the nat'l debt.”

We need real, fiscally responsible #TaxReform that doesn't explode the nat'l debt. https://t.co/h0iBN2wcoD

— Jeff Flake (@JeffFlake) November 9, 2017

Senator Chris Murphy (D-Connecticut) had some harsh words for the tax cuts outlined in the Senate bill: “The GOP tax bill isn't for you. It's for their billionaire and corporate donors. And they're not even trying to hide it.”

The GOP tax bill isn't for you. It's for their billionaire and corporate donors. And they're not even trying to hide it. https://t.co/XBlqC5Mz5R

— Chris Murphy (@ChrisMurphyCT) November 9, 2017

Another potential wildcard for the GOP’s tax proposal is libertarian-leaning Senator Rand Paul (R-Kentucky), who is currently in the hospital with six broken ribs following an attack, allegedly by his neighbor last week.

It is not clear yet whether a yes or no vote from Paul will have a lasting effect on the outcome of passing the tax overhaul bill, or if he will even be present for a final vote on the legislation, as he is still recovering from his injuries.