Huge stock market collapse is coming – investment guru Mark Mobius

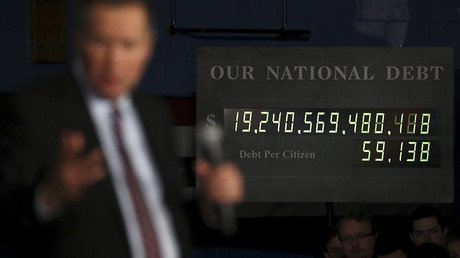

Following Jim Roger’s latest prediction of the “biggest crash in our lifetimes,” famed 81-year-old investor Mark Mobius says the US stock market is set for a huge correction that would be trouble for everyone.

“I can see a 30 percent drop. The market looks to me to be waiting for a trigger to tumble,” Mobius said, as quoted by the London-based Financial News.

According to Mobius, the former executive chairman at Templeton Emerging Markets, all the indicators now point to a great fall in the S&P 500 and the Dow Jones. “The consumer confidence is at all-time high in the US, and it’s not a good sign,” he said. “The market looks to me to be waiting for a trigger that will cause it to tumble.

“You can’t predict what that event might be – perhaps a natural disaster or war with North Korea,” he said, stressing that a fall in the US market would mean trouble for everyone.

The veteran investor, who predicted the start of the bull market in 2009, warns that any drop could be strengthened by the increasing use of exchange traded funds (ETFs), which account for nearly half of all trading in US stocks. The ETFs could evoke further declines once markets fall.

“You have computers and algorithms working 24/7 and that would basically create a snowball effect. There is no safety valve to prevent further falls, and that fall would escalate very quickly,” Mobius told the media. “ETFs represent so much of the market that they would make matters worse once markets start to tumble.”

Russia going kitty crazy amid falling ruble https://t.co/rM1Ol0izDNpic.twitter.com/2wOJMzobLW

— RT (@RT_com) April 18, 2018

Earlier this year, another investment veteran, Jim Rogers, said that the next bear market would “be worst in our lifetime.” One of the world’s richest men, Bill Gates, said that a 2008-like financial crisis was a certainty.

For more stories on economy & finance visit RT's business section