US in lockdown: The biggest threat to the oil industry ever?

The impact of border closures, travel restrictions, restaurant closures and more is already wreaking havoc on the US oil industry, and it is likely to get much worse.

The SARS CoV2 virus that is behind the COVID-19 pandemic has finally ravaged the United States, and cities and states are reacting to its brutality by shutting stuff down. As the United States continues to increase measures to isolate the sick and slow the spread, the oil industry is bracing for harder times ahead. Just how bad could it get, and what would a full quarantine mean for US oil?

The effects of US border closures, travel restrictions, school shutdowns, bar and restaurant dining-in shutdown are already hitting the US oil industry hard.

Also on rt.com April could be WORST MONTH EVER for oilThe primary US oil benchmark - West Texas Intermediate, has fallen by about $30 per barrel over the last month, making it difficult or impossible, rather for US oil producers to turn a profit.

The breakeven for most US producers is above the current $22.61 as of 8:15 am EDT.

And while the profit crunch will no doubt cripple smaller producers and oilfield service providers that don’t have their hands in other ventures, the industry is facing even more challenges due to the virus.

Oil Demand Set to Crash

While Saudi Arabia and Russia gear up to flood the world with crude oil, demand for oil is falling off sharply. At first, the world was freaking out about a slowdown in oil demand growth. Those concerns seem paltry now. Today, we’re talking about a straight-up slump in oil demand.

Travel bans and government directives that have shut down everything, and businesses that are self-directing full shutdowns including the shutdown of US automakers and encouraged people to stay at home are already taking a big bite out of oil demand in the US.

A full quarantine would be even more devastating.

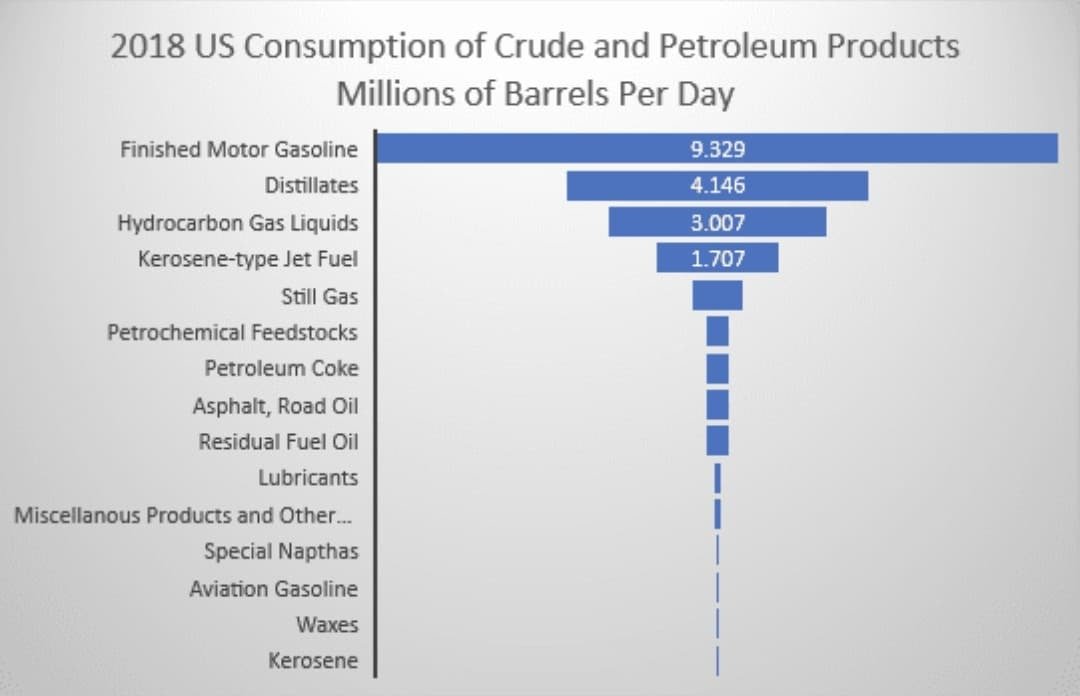

The United States is the largest consumer of crude oil in the world, consuming 19.96 million bpd - or 20 percent of the world’s total, and the transportation sector is the backbone of this demand, accounting for 9.329 million bpd of all petroleum products consumed in the US in 2018, according to the Energy Information Administration (EIA).

Distillates, too, are comprised of some transportation-sector demand in the form of diesel.

While some sky-is-falling analysts and wishful-thinking environmentalists have long predicted that demand for crude oil will peak within the next few years due to the rise of the EVs, COVID-19 is proving a far more worthy and immediate foe.

The oil market is already melting down on coronavirus fears, and only a handful of cities and counties - including the Bay Area in California (pop. 7 million), San Miguel County in Colorado (pop. 8,000),

Starting Thursday, Fresno (pop. 530,000) a shelter-in-place order will go into effect, and starting Friday, additional shelter-in-place measures will be implemented in Oak Park in Illinois (pop. 52,200).

While certainly disruptive to the transportation sector, these shelter in place orders are just a small portion of what a national shelter-in-place order would be, which would restrict the movements of 329 million people.

Of course, even a full-scale shelter-in-place order wouldn’t see demand from the transportation sector fall to zero - some forms of public transportation would still run, critical infrastructure workers would still be moving to and fro and emergency services would still be in full swing. But even a 50 percent reduction in transportation-related oil demand would see about 5 million bpd stripped away from the total oil consumption in the US.

The slackening demand caused by such a drastic, if not necessary, action would result in a surplus of oil to the tune of 35 million barrels per week unless production dropped to match - and it eventually would.

For perspective, weekly API- and EIA-reported crude inventory moves in the United States rarely lose or gain more than 9 million barrels.

Already the low price situation, stemming from the imaginings of panicked traders as well as the reality of growing supplies and shrinking demand, oil majors are scrambling to find places to store crude oil. Last week, Shell was looking to charter three VLCCs to store crude oil in anticipation of the deluge of oil that Saudi Arabia was planning to export.

But storage space is finite.

FitchRatings, which updated its price forecasts on Thursday for oil, “in expectation of very large market oversupply in 2020.”

According to Bjornar Tonhaguen of Rystad Energy, “the market will soon come to realize that it may be facing one of the largest supply surpluses in modern oil market history in April.”

And if the tight crude oil storage isn’t enough of an issue, oil majors are also looking to store jet fuel at sea - a far trickier endeavor than storing crude oil due to its more delicate nature.

On Thursday, the US is expected to announce even greater travel restrictions - urging US citizens not to travel abroad - a level 4 travel advisory. This will further dent oil demand and is another step closer to a full lockdown.

The US government is also said to have created a 100-page report outlining its plan to prepare for the coronavirus situation to last 18 months. If this preparedness turns out to be on point, it, too, will cripple oil demand in the United States.

This article was originally published on Oilprice.com