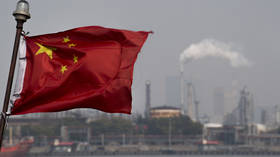

China set to dominate refined oil exports in Asia-Pacific region

A rapid increase in China’s crude oil refinery capacity will see it dominate exports in the Asia-Pacific region (APAC), particularly to Australia where concerns are growing of a vulnerability in the supply chain, experts say.

China customs data shows that the country’s exports of refined oil products to Australia rose from a few thousand tons before 2011 to nearly 300,000 tons at the end of last year. And Australia’s reliance on imports is expected to continue given the announced closure of two of its last four refineries.

“The reason we see China as the main potential import source is the country’s rapid increase in refinery capacity combined with a slower growth in domestic oil products demand in the long term,” oil markets analyst at Rystad Energy Julie Torgersrud was quoted as saying by the South China Morning Post. “New, high-complexity refinery capacity starting up in China puts increased pressure on competing refiners in the APAC region, who are suffering from lower margins and usually have older, less efficient operations.”

Also on rt.com Asia to account for 90% of global oil demand growth through 2025 – IEARystad Energy expects a net decrease in refinery capacity of around 1.2 million barrels per day (bpd) in the region in the next two years, “compared to a net increase in China of 1.5 million bpd in the same period.”

Politicians and experts in Australia have been voicing concerns about the increasing reliance on China. Torgersrud also says that India could become another nation to export to Australia, which would allow supply diversification. However, Beijing’s push to lift export quotas in refined products and its refining capacity of 600,000 barrels per day this year is a sign of its dominance, she added.

The closure of Australia’s refineries means crude refining this year will drop by 50% year-on-year, but with demand increasing, imports will rise by 18%. Australia, which imported about 65% of its refined oil products, was turning its decommissioned refineries into import terminals to combat weakened supply chains. The Australian government confirmed in 2019 that new refineries would be a thing of the past.

Also on rt.com Russia looks to replace banned Australian coal exports to China“When it comes to energy security, increased dependence on imports puts pressure on reliability of shipping and supply chains, but this is the reasoning behind old refineries converting to continue operating as import terminals, as these facilities will become increasingly important,” Torgersrud said.

For more stories on economy & finance visit RT's business section