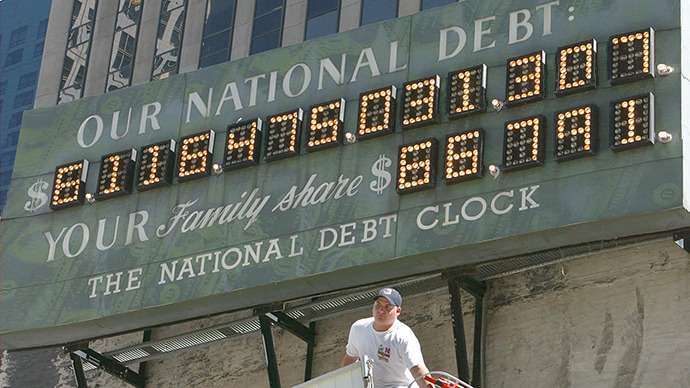

Ceiling suspended: US takes on $300bn in new debt after hitting $16.7 trillion

America’s ticking debt bomb has been reset. Washington has suspended the debt ceiling, setting a date, and not a concrete dollar sum as a deadline, an unprecedented first in US history.

Citing ‘extraordinary measures’, the US Treasury has further

delayed tackling America’s debt, and will wait until Labor Day,

September 2nd, to revisit the burgeoning crisis. The ceiling has

been lifted, and the Treasury has promised it will keep cash

pumping into government spending programs beyond the debt limit

through a series of emergency cash tools.

“It will not be until at least after Labor Day" when

Washington will have reached their full borrowing capacity,

Treasury Secretary Jacob Lew, told CNBC television on May 10th.

Until then, the Treasury will borrow money to mend any gaps between government spending and revenues, adding to the already $16.7 trillion debt.

On Friday, the Treasury Department announced it will suspend sales of State and Local Government Series loans (SLGS) until further notice. The suspension applies to demand deposit and time deposit securities.

In the last four months, the US has accumulated $300 billion in

debt. The Congressional Budget Office forecasts that the federal

deficit will be $642 billion in FY13.

The US economy has shown some promising signs of recovery. US

consumer sentiment rose to its highest level in almost six years,

jumping from 89.9 to 97.5, the highest post-recession consumer

condition, the University of Michigan study found.

“The global economic leadership position enjoyed by the United

States rests on the confidence of Americans and people around the

world that we are a nation that keeps its promises and pays all of

its bills, in full and on time,” said Lew.

US lawmakers first agreed to raise the debt ceiling two years ago,

following a long, drawn out stand-off between Republicans and

Democrats, which prompted Standard & Poor to strip the US of

their AAA rating. The failed super committee ushered in

sequestration,

This time around, Lew has urged lawmakers to act more swiftly to

not tarnish the reputation of the US economy.

"Congress should deal with this right away. The fact that they

have more time should not put off dealing with this," he said.

"I don't think that it's in the interests of the U.S. or the

world economy for Congress to wait until the last minute and create

a sense of anxiety,” said Lew.

Lew hinted the debt ceiling is not up for negotiation, and that

Obama would not bow to Republicans increase the debt ceiling but he

does remain open for talks about a deficit deal.

Lew was sworn in as Treasury Secretary on February 28th, 2013,

after Congress voted in favor of raising the debt

ceiling in January to avoid a default on the debt.