New bill would bar employers from requiring credit checks of potential hires

Employers would no longer have the right to attain a prospective employee’s credit report, or to deny a job applicant based on credit status, under a bill introduced Tuesday in the US Senate.

Sen. Elizabeth Warren (D-MA) and six other senators proposed the Equal Employment for All Act, which would aim to end the ability of employers to run credit checks on possible employees, currently a common practice.

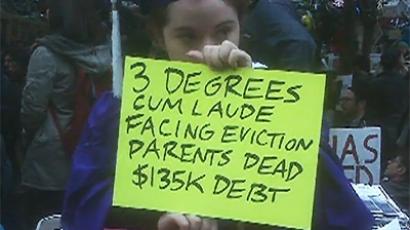

Advocates of the measure says employer credit checks are a high, needless barrier of entry into the labor market for many with poor scores. Supporters add that the employer checks contribute to long-term unemployment and have disproportionately impacted women, minorities, students and seniors.

"There's little or no evidence of any correlation between job performance and a credit [report]," Warren said Tuesday, according to CNN. "[T]his is a point of basic fairness...people who get hit with hard economic blows end up getting squeezed out of the system. This is another way the game is rigged against hardworking middle-class families."

The think-tank Demos found in a report this year that one in ten unemployed Americans were denied a job based on credit status. Demos said the report evaluations target anywhere from entry-level positions to senior management staff.

Whether employer checks are legal or not, a study by the Federal Trade Commission released in February showed errors in credit reports are common. The FTC revealed that one in five consumers has an error on their credit report.

Employers are allowed to check credit history under the Fair Credit Reporting Act, which requires the prospective employee’s consent. A 2012 survey by the Society for Human Resource Management found that 47 percent of employers use credit checks when considering hires.

“A credit check can serve an important function in certain jobs, especially in the financial services industry,” said Elizabeth Milito, senior executive counsel at the National Federation of Independent Business, according to The Washington Post. “A blanket prohibition would disadvantage many businesses that use credit as one component of a background check.”

The bill allows an exemption for positions in the government that require a national security clearance.

Over 50 advocacy groups signed a letter Tuesday in support of the legislation.

"Discriminatory credit checks are bad for employers, they're bad for job seekers, and they're bad for our economy. In order to have an inclusive recovery where all Americans have a chance to take part, Congress must pass the Equal Employment for All Act," said Nancy Zirkin, executive vice president of The Leadership Conference on Civil and Human Rights.

The bill has no Republican support in the Senate, The Washington Post reported.

A similar measure was proposed in the House in 2011, though the legislation did not make it past the committee level.

In the past three years, 10 US states have barred employers from demanding credit checks for job applicants.