Big US banks balk at funding Great Barrier Reef coal port

Citigroup, Goldman Sachs, Morgan Stanley and JPMorgan Chase have joined the list of banking giants opting out of a major Australian coal export project, Rainforest Action Network activists say.

The four banks have become the latest global financiers not to participate in funding the Abbot Point coal port expansion. The area located in Queensland in Australia is close to the Great Barrier Reef, a world heritage site.

Rainforest Action Network, a US environment group, confirmed getting commitments from each of the banks ruling out funding the project, the Guardian reports.

Abbot Point expansion is being coordinated by Indian mining concern Adani in partnership with Australia’s GVK. The companies received government approval to build a new port terminal to be linked by a 300 kilometer railway to Queensland’s Galilee Basin coal field.

The move by banks follows a lengthening list of statements by Deutsche Bank, Barclays and HSBC who declared they will keep away from the world’s largest new coal development.

Thomas Jacquot, a credit analyst with rating agency Standard & Poor's, said the pullback of more banks would add to the difficulties already faced by the mine developers, reports the Sydney Morning Herald.

"The maths look challenging," Mr. Jacquot said. "I'm ultimately very curious because the coal market is very depressed."

Adani Group and GVK are attempting to secure an estimated $26.5 billion in external financing necessary for the planned expansion of coal export facilities and associated mine and rail infrastructure at Abbot Point.

Blair Palese, chief executive of climate activist group 350.org, told the Guardian that coal projects such as Adani’s were facing a “perfect storm” of falling coal prices and reluctant investors.

The Abbot Point project’s viability will partly depend on whether Australian banks join the financing.

Mining in the undeveloped Galilee Basin has been the subject of a campaign by anti-coal activists, who pressed institutional investors and big banks to avoid investment and help combat climate change.

"Stopping Abbot Point is a top priority for us, because this single project is the key to whether one of the largest stores of carbon on the planet, the Galilee Basin, stays in the ground where it belongs, or is sold on the global market and released into our atmosphere," Amanda Starbuck, a director at San Francisco-based Rainforest Action Network, told Reuters.

Environmental organizations all over the world have expressed concerns about the consequences of coal exploration in the region. According to estimates, the volume of greenhouse gas emissions from nine coal mines of Galilee Basin may result in over 700 million tons of CO2 per year.

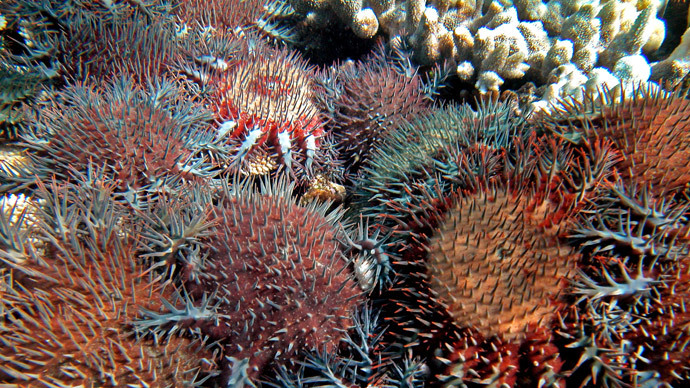

The Great Barrier Reef is one the world’s largest coral reef systems and the biggest single structure made by living organisms. It has an area of more than 340,000 square kilometers and can be seen from outer space. The Great Barrier Reef has been listed a World Heritage Site by UNESCO.