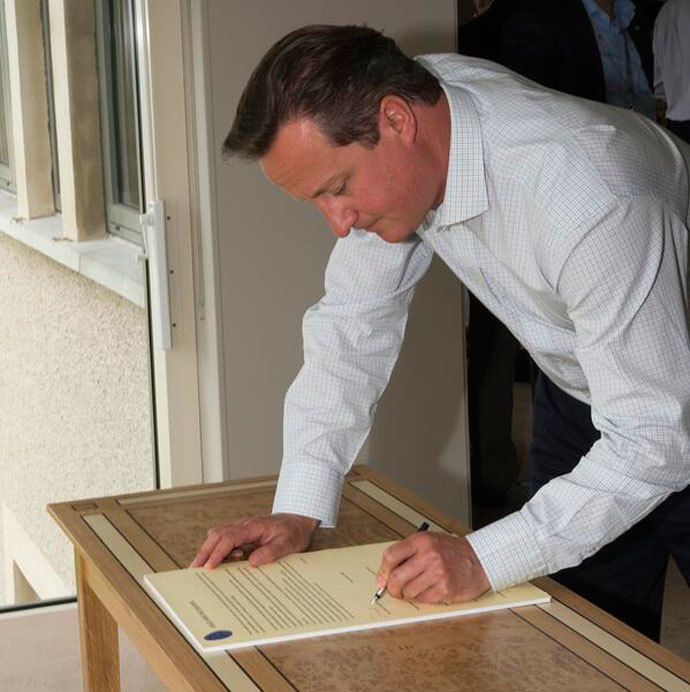

G8 leaders sign tax evasion declaration

G8 leaders have signed the 'Lough Erne Declaration', pledging to change the international financial scheme that currently allows individuals and companies to hide money and avoid paying taxes, thus creating a more transparent international economy.

After two days of resolutions on ‘the three Ts’ – tax, trade, and transparency- leaders have signed a concluding summit document to update tax rules which date back half a century to the League of Nations.

"You have to collect the taxes that are owed," Cameron said at his press conference.

"Tax authorities across the world should automatically share information so those who want to evade taxes have nowhere to hide," said Cameron.

All G8 leaders signed the Long Erne Declaration, which sets out to drive growth, reduce poverty, create jobs, and promote prosperity. The document states the following can only be accomplished under fair and transparent tax and trade laws, which must be managed by good governance.

"You're going to see concrete achievements today on changing the international rules on taxation, so individuals can't hide their money offshore and companies don't shift their profits away from where the profit is made," George Osborne, UK Chancellor, told the BBC before the official meeting.

David Cameron attended a key discussion on tackling tax evasion to provide a blueprint ahead of the G20 meeting in St. Petersburg in September, where it is expected a final cooperative directive will be issued to put a halt to tax evasion.

Company directors have a "duty" to ensure their firms pay fair share of tax as well as maximize shareholder value, said Paul Collier, director of the Center for the Study of African Economies at Oxford University and an adviser to Cameron.

Downing Street released and official document after the meeting, the 'UK Action Plan to prevent misuse of companies and legal arrangements' which states the UK's commitment to implementing transparency in corporate governance.

The post-recession economic climate has led to stiff competition between struggling G8 economies for both investment and tax revenue. Governments can no longer afford to miss out on tax revenue from companies or individuals stashing their money in havens.

An estimated $8.5 trillion sits in offshore accounts, which

doesn’t draw tax revenue back to the source of the wealth, and

has come under attack from politicians as the economic crisis

deepens.

“I am particularly pleased to fight against offshores because

it’s not not only a problem for Russia but for the entire world

economy," Russian President Vladimir Putin said in his press

conference, pointing to Cyprus as a case study of how a rogue

offshore can derail and hinder investment worldwide.

Companies, use creative tax schemes to shelve profits and avoid taxes, a practice which is currently not a criminal offense.

‘Britain must put its own house in order’

UK leaders may find it difficult to convey to their international counterparts they are ready to lead the effort against tax evasion, as they have made little ground at home on the issue.

It is estimated one fifth of the world’s illicit tax haven money is situated in accounts in British Overseas Territories and Crown Dependencies, and in 2012, the UK lost $156 billion in tax revenue from those individuals who dodged mainland taxes, instead keeping their assets offshore.

Tax evasion has a €1 trillion effect on the EU economy, and in Britain, at least $150 billion is lost to tax schemers.

Oxfam, a UK-based charity, estimates that some $18.47 trillion is being held by individuals in tax havens around the world. Of this some $7.18 trillion is in accounts situated in British Overseas Territories and Crown Dependencies.

"Of course Britain's got to put its own house in order," said Osborne before the meeting.

It will be a long and drawn out process, because some countries have specifically catered and developed their economies around the loose tax haven regulations, most notably Switzerland, Austria, and Luxembourg, which have become financial hotspots because they offer a niche for low corporate taxes.

The tax evasion would need to be a global overhaul, because if just one country decides not to comply, and offer lower tax rates for people trying to hide money, the whole effort is void.

EU leaders met in Brussels on May 22 and agreed to aggressively dismantle the dangerous tax loopholes and havens through 2020.

The tax evasion topic spills into the transparency theme, which focuses on developing countries and commodities.

Call for transparency

The UK wants to create a public tax register, a country by country report on taxes, which would bring to light to any ‘shell companies’ operating abroad engaging in tax evasion gimmicks.

A shell company is a subsidiary of a multinational set up in another country with lower corporate tax rates in order to ‘hide’ their liabilities from taxes in their home country. Apple has come under fire for setting up offices in Ireland, where they paid less corporate taxes than they would in America, but they are not alone.

Osborne has stressed taxes should be paid where the profits are generated, whether it’s Apple, or a natural resource company mining in Africa.

On Monday US President Obama and Cameron officially announced

plans to create the ‘biggest

bilateral trade deal in history’.