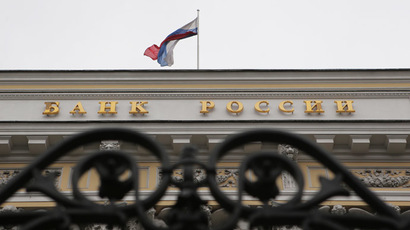

Russian central bank to use new $50bn tool to revive ruble

Russia's Central Bank has launched a new financial tool known as currency repo, or repurchase agreement, that'll provide up to $50 billion by the end of 2016. It is expected to support the Russian ruble that has lost more than 20 percent since January.

Russia’s key regulator is launching a new instrument on Monday, with the first auctions scheduled for October 29.

"These operations are aimed at further empowering credit institutions to manage their own short-term currency liquidity,” the bank said in a press release.

Put simply, the Central Bank of Russia is providing the country’s financial institutions with the much needed dollars that it will buy them back later, with interest. This is to relieve the pressure on the ruble that has been falling dramatically because of the political turmoil over Ukraine and cheapening oil.

READ MORE: 6 useful things you need to know about the rapid descent of the Russian ruble

Unlike currency interventions, repurchase agreements don’t eat into the country’s reserves, which should make it a more favorable tool.

The Central Bank has already spent $13 billion in October to slow the ruble’s devaluation, but it hopes to abandon its intervention strategy and move on to a free floating ruble next year. Foreign exchange reserves will be used just for a "particular balancing" of the exchange rate, President Vladimir Putin said Friday to the Valdai discussion club in Sochi.

The periods of repo auctions will be either 7 or 28 days. The price of lending money will be 2.12 percent for 7 days and 2.37 percent for 28 days. Foreign currency repo transactions will be weekly settled in dollars and euro at the Moscow stock exchange. The Central Bank has set the aggregate maximum amount of debt in foreign currency repo transactions for the banks until the end of 2016 at $50 billion.

Some Russian analysts believe the new tool should help relieve pressure on the ruble.

"If the Central Bank makes the right estimates, we will immediately feel relief", Evgeniy Nadorshin, chief economist for Russian financial group AFK Sistema, told RBC. “Anyway, a total of $50 billion should be enough to relieve the tension in the foreign exchange market.”

Oleg Kuzmin, chief economist for Russia and the CIS at Renaissance Capital, believes if banks receive $35-40 billion before the end of the year, the situation on the currency market will be fully stabilized. The foreign exchange repurchase mechanism will be needed before the peak period in December when Russian companies and banks pay off their foreign currency debts amounting to around $35 billion.