FED official responsible for quantitative easing: 'It was the greatest backdoor Wall Street bailout'

A former Federal Reserve employee responsible for managing the agency’s quantitative easing program has written an op-ed apologizing for what he called “the greatest backdoor Wall Street bailout of all time.”

Writing in the Wall Street Journal, Andrew Huszar detailed his concerns about the Fed’s massive bond-buying measures. He argued that while the Reserve initially claimed the program would lower borrowing rates for average citizens, the trillion-dollar initiative primarily ended up lining the pockets of Wall Street executives.

“Despite the Fed's rhetoric, my program wasn't helping to make credit any more accessible for the average American,” Huszar wrote. “The banks were only issuing fewer and fewer loans. More insidiously, whatever credit they were extending wasn't getting much cheaper. QE may have been driving down the wholesale cost for banks to make loans, but Wall Street was pocketing most of the extra cash.”

What’s more, Huszar claimed that several Federal Reserve managers expressed apprehension over the effects of quantitative easing (QE) only to find their concerns ignored.

“Our warnings fell on deaf ears,” he wrote. “In the past, Fed leaders—even if they ultimately erred—would have worried obsessively about the costs versus the benefits of any major initiative. Now the only obsession seemed to be with the newest survey of financial-market expectations or the latest in-person feedback from Wall Street's leading bankers and hedge-fund managers.”

Between 2009 and 2010, Huszar helped manage the purchase of $1.25 trillion in mortgage bonds before leaving the Fed for the second time to return to the private sector. The op-ed claimed that QE policy has relieved lawmakers in Washington from the pressure to address the weak economy, but that the $4 trillion spent purchasing bonds has only resulted in .25 percent GDP growth.

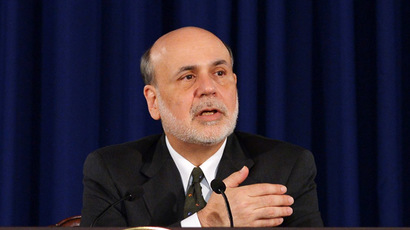

Still, QE as policy is likely to stick around in the near-term. President Obama’s choice to replace Ben Bernanke as Fed Chairmen, Janet Yellen, supports keeping the program in place for as long as the economy continues to lag. Some economists, meanwhile, believe that QE has outlived its usefulness and should be terminated.

The Senate Banking Committee will hold a confirmation hearing for Yellen on Thursday, November 14. If approved, her nomination will move to the Senate floor, where she’s likely to have the votes to become the first woman to head the US central bank.